Embarking on the homebuying journey, especially in a market with higher interest rates, requires savvy navigation of various financing strategies. One option that often flies under the radar for prospective homebuyers and real estate agents is utilizing a seller credit for a temporary interest rate buydown. While hunting for homes with reduced purchase prices is a standard practice, there’s a hidden gem in considering temporary buydowns that could significantly impact your financial strategy and expand your purchasing capabilities. This blog post will unveil these substantial benefits, emphasizing why this method could be an integral part of your home acquisition toolkit.

Expanding Your Property Horizon

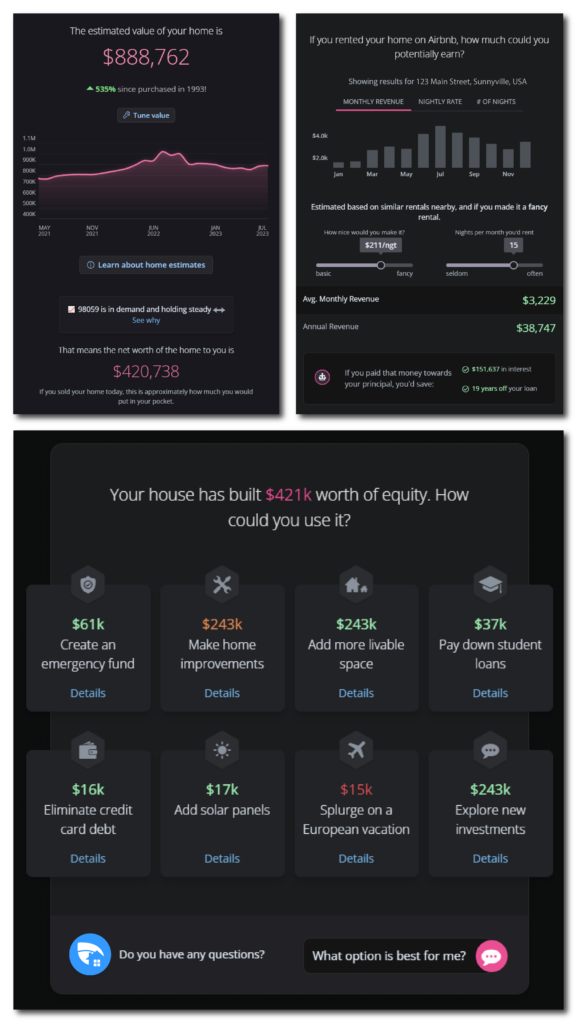

A seller credit for a temporary interest rate buydown can be a golden ticket for buyers operating within strict budget parameters. This approach decreases initial monthly mortgage payments, potentially qualifying you for homes that tick more boxes on your preference list. For real estate agents, this means you can present clients with a wider, more attractive array of properties, increasing the likelihood of a successful transaction that satisfies all parties.

Enhancing Financial Security

The immediate benefit of lower monthly mortgage payments through a temporary interest rate buydown is a financial boon in itself. This strategy acts as a buffer against unexpected homeownership costs and provides an opportunity for strategic financial allocation, whether for home improvements, investments, or other expenses. It’s particularly beneficial for first-time or financially cautious buyers, creating a safety net during the initial years of homeownership.

Smart Refinancing Opportunities

One of the standout advantages of temporary buydowns comes into play if you choose to refinance within the first years of the loan term. Unlike permanent buydowns, where the cost to buy down to a lower interest rate is essentially “lost” if you refinance, temporary buydowns offer a unique benefit. Any seller credit that hasn’t been used yet for the interest rate reduction can be applied directly to the loan’s principal at the time of refinancing. This means you’re effectively lowering the total loan amount, resulting in substantial long-term savings. This feature is a game-changer, offering financial flexibility and making temporary buydowns a smart choice for buyers anticipating early refinancing.

While the pursuit of the lowest price is standard in homebuying, the advantages of seller credits for temporary interest rate buydowns present compelling reasons to consider this underutilized strategy. Beyond the immediate relief in monthly mortgage payments, it offers financial security and a unique refinancing opportunity that safeguards your investment even further.

Nevertheless, such a decision should be made after meticulous consultation with loan advisors to ensure it fits your financial situation and homebuying goals. By understanding the profound potential of seller credits for temporary interest rate buydowns, homebuyers and real estate agents can wield this tool effectively, ensuring a more strategic, financially sound property purchase.

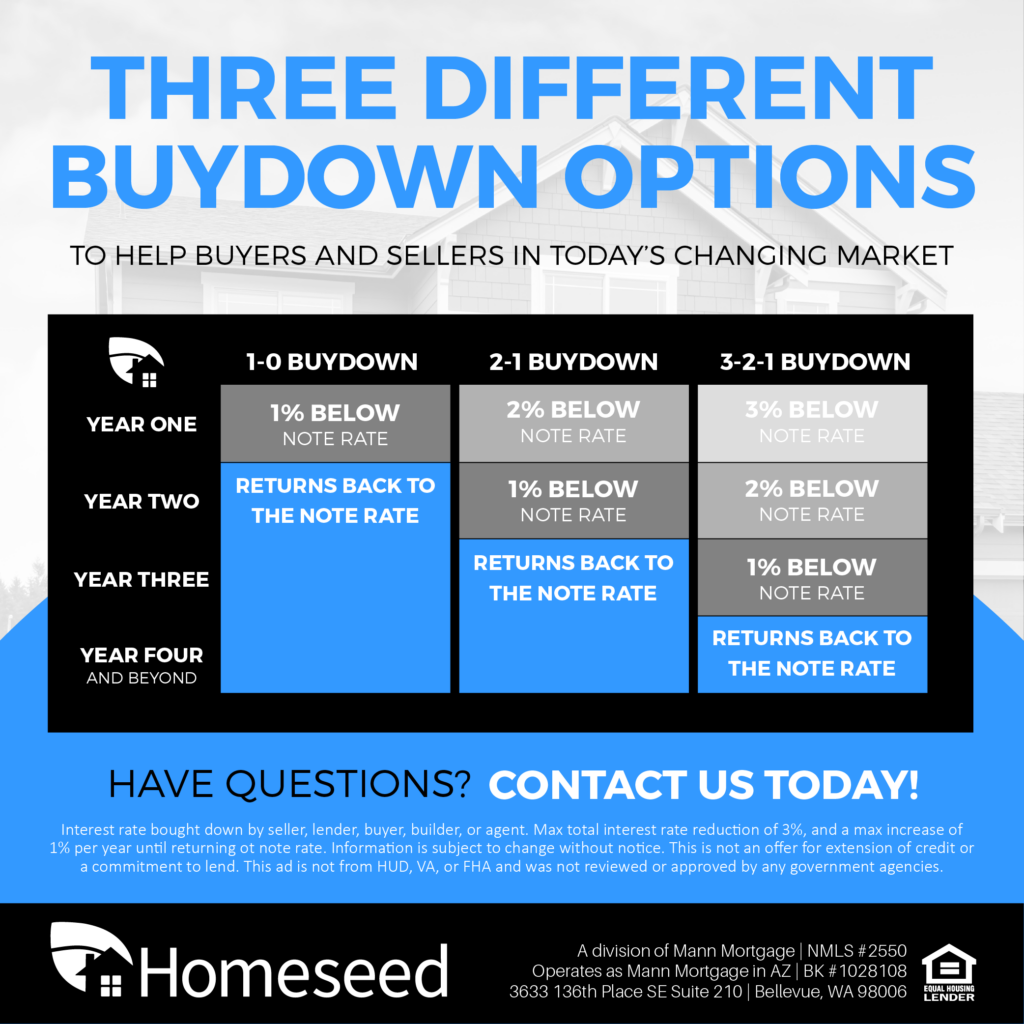

Temporary buydowns are financing options that allow borrowers to lower their initial mortgage interest rates, which gradually increase over a specified period. Three types of temporary buydowns offered by Homeseed are the 1-0 buydown, the 2-1 buydown, and the 3-2-1 buydown.

- The 1-0 buydown involves a borrower paying an initial interest rate that is 1% lower than the actual rate for the first year of the loan. The interest rate will then revert to the fully indexed rate in the second year and remain constant for the remainder of the loan.

- With a 2-1 buydown, the borrower starts with a rate 2% lower than the fully indexed rate in the first year, and in the second year, the rate is 1% lower than the fully indexed rate. The interest rate will then revert to the fully indexed rate in the third year and remain constant for the remainder of the loan.

- The 3-2-1 buydown structure offers the most significant initial reduction. In the first year, borrowers pay a rate that is 3% lower than the fully indexed rate. In the second year, the rate decreases to 2% below the fully indexed rate, and in the third year, it becomes 1% lower than the fully indexed rate. After this three-year period, the interest rate reverts to the fully indexed rate and remains constant for the remainder of the loan.